Novia has stolen a march on many of its peers by forging ahead with bringing discretionary fund managers onto its platform. It offers access to a wide range of DFMs: currently 60 and counting. In this week’s platform focus, we take a look at why it has been so successful in attracting DFMs and what steps it is taking to realise chief executive Bill Vasilieff’s ambition of offering the best investor experience in the market.

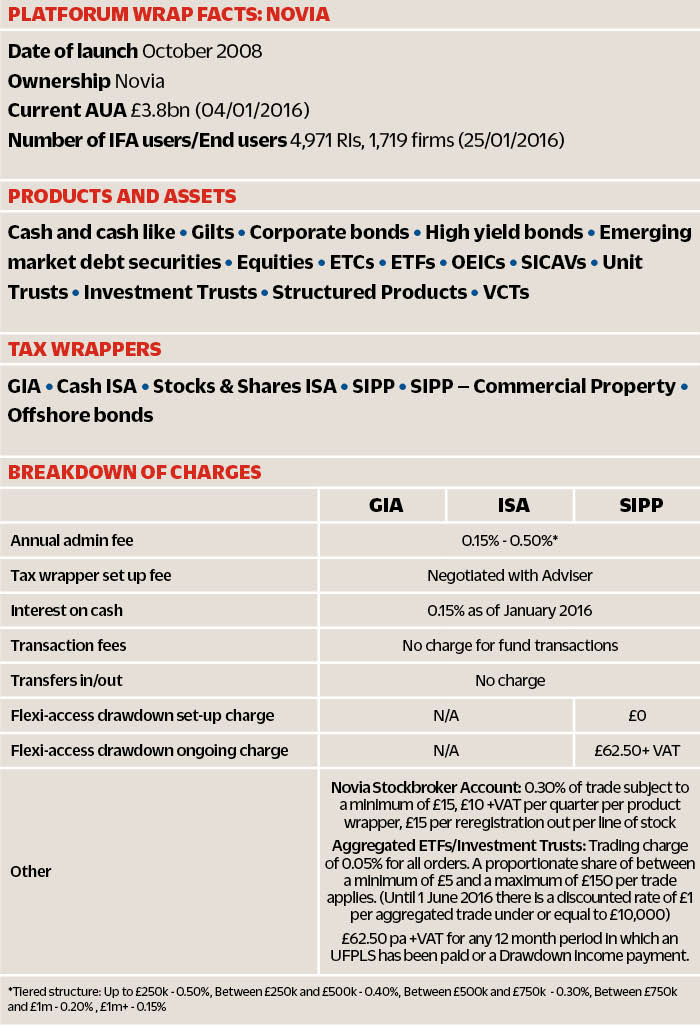

Novia’s assets under administration grew by 25 per cent year-on-year (as at Q3 2015) although from a smaller base. It now stands at £3.8bn.

The feedback we hear from advisers is that Novia is easy to work with and gets some important things right. For example, those looking for access to a wide range of on-platform model portfolios should be attracted by the choice available on Novia.

DFMs we have spoken to find the platform easy to work with. They say it makes it easy for them to get paid and its sales team works with them to help attract new business into their model portfolios. Novia also operates its own DFM, Copia Capital Management.

The wide range of collectives, asset classes and instruments available on-platform also makes Novia well suited to facilitating DFMs’ model portfolios. The platform tells us it has seen ETF use grow rapidly, albeit from a small base. It has just announced a deal with Winterflood to use its new trading system to improve access to ETFs for its users. Winterflood’s automated service trades can cost as little as £1 (although advisers should also consider the spread between bid and offer prices for small trades).

Novia has also been investing in updates to its tools and technology, with a move to version 12 of the core administration system provided by GBST coming up.

Our user scores for the platform’s web usability, usefulness of online tools and ease of doing business have been dipping, so it is encouraging to see it is taking action to address this.

There is a new look Investor Zone, which looks clean with clear and simple graphics and charts. It is now tablet friendly and provides e-delivery of half-yearly statements. Previous statements will also be archived online. The next phase is to put contract notes online as well. Advisers tell us they want paperless systems, so it is good to see Novia taking note. We have been impressed by the updates to the platform’s Model Portfolio Manager, a tool that can be used by advisers and DFMs alike. Novia trains all adviser firms to use Model Portfolio Manager, as it enables rebalancing. Advisers can link clients to models and DFMs can load specific models against specific advisers. It also prohibits using net funds if a gross fund is available on-platform, ensuring the most tax efficient route is taken. We were particularly taken with its database of corporate actions, which are automatically flagged and therefore helpful for advisers needing to notify clients.

Novia’s book price ranges from a modest 0.15 per cent for portfolios of £1m-plus, to a punchy 0.5 per cent for portfolios of up to £250,000. With average platform charges settling at around 0.35 per cent this suggests to us Novia is focused on attracting investors with portfolios in excess of £250,000: a rarefied pool indeed. Novia must articulate its value to these investors and their advisers. New business is a clear focus and this group of investors is sought after. Other platforms will be circling.

Chief executive Bill Vasilieff tells us his ambition is to make Novia’s investor experience the best in the market. Its recent investment in technology combined with its comprehensive range of funds and instruments shows it is making the right moves. However, some of the advantages Novia has over less-nimble rivals will fade in time.

The challenge will be to continue to innovate to be able to maintain its lead.

Miranda Seath is senior researcher at Platforum

No comments:

Post a Comment