This week I am going to continue my detailed look at the salary versus dividend versus pension conundrum I started before the summer break. When considering the available options there is no real substitute for number crunching once the principles are understood. What follows are some examples applying the principles I discussed in the past couple of articles on this most important subject.

Example one shows a one-person company wanting to keep income within the basic rate band, with no employment allowance available.

Table 1.1 shows the dividend benefits from both the £5,000 dividend allowance and the £2,940 of unused personal allowance. Suffering 20 per cent corporation tax on the dividend is better than the position for salary that bears no income tax, but 25.8 per cent employer/employee National Insurance contributions, of which only the employer's is tax-relieved. The extra net income comes with a greater slice of the profit. If the gross profit is kept the same for salary and dividend, table 1.2 is applicable.

Example two shows a one-person and single other employee company wanting to keep income within the basic rate band, with at least £2,888 of income covered by employment allowance.

The bottom line in table 2.1 is £352.80 less than in table 1.1 but the gross profit cost is £735 lower because an extra £2,940 has been extracted as employee NIC-able salary rather than dividend, thereby avoiding any corporation tax charge. If we repeat the calculation with the same gross profit as the salary only option, the results in table 2.2 are applicable.

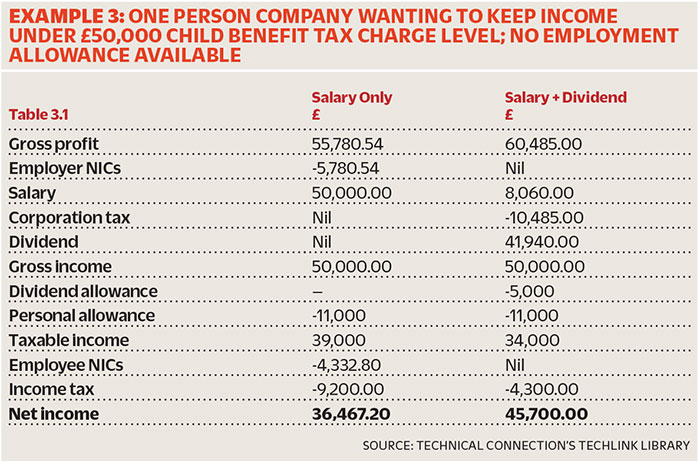

Example three shows a one-person company wanting to keep income under £50,000 child benefit tax charge level, with no employment allowance available.

Again, the dividend route absorbs more (£4,704.46) gross profit, which boosts the resulting net income (by £9,232.80). If at least £2,888 of income is covered by the employment allowance then, as in table 2.1, there would be a cut of £735 in the gross profit cost for the salary and dividend option, and a corresponding reduction in net benefit of £352.80 due to employee's NICs. I will look at a few more important examples next week.

Tony Wickenden is joint managing director of Technical Connection. You can find him Tweeting @tecconn

The post Tony Wickenden: Crunching the numbers on salary, dividend or pension appeared first on Money Marketing.

No comments:

Post a Comment